Leftists heads must have exploded all over Dane County as they sipped their lattes this morning after they read this one...

The sorry state of our neighbors to the south

Wisconsin State Journal editorial madison.com Posted: Sunday, February 5, 2012

Say what you will about Gov. Scott Walker's first year in office, but Wisconsin isn't facing "financial disaster."

Wisconsin hasn't had its credit rating downgraded to lowest in the nation — even worse than California's.

Wisconsin isn't sitting on a pile of unpaid bills totaling $9.2 billion that's projected to quadruple in five years.

No, that sad narrative belongs to our neighbors in Illinois. And it's a testament to the need for fiscal discipline across all levels of government, regardless of which political party is in power.

Illinois Gov. Pat Quinn's solution to a massive state budget deficit last year was largely to raise personal and corporate income taxes.

It didn't work.

The Civic Federation, a financial government watchdog group in Chicago, released a report last week warning that "failure to address unsustainable trends in the state's pension and Medicaid systems will only result in financial disaster for the state of Illinois," according to the group's president, Laurence Msall.

Moody's Investors Service last month downgraded Illinois' bond rating to lowest in the nation, citing excessive borrowing and "no steps to implement lasting solutions." A lower bond rating will increase the interest rate Illinois pays when borrowing money.

The Pew Center on the States last year cited Illinois for having the worst-funded pension system in the nation.

Even many of Illinois Gov. Quinn's fellow Democrats were questioning his call for new spending in his State of the State speech last week.

"Show me the money," responded Democratic Rep. Joe Lyons of Chicago, according to the Chicago Tribune.

Wisconsin's fiscal condition is far from perfect, of course. When strict accounting principles are applied to Wisconsin's finances, a deficit of about $3 billion persists. Wisconsin, like most states, uses cash-based accounting instead of generally accepted accounting principles. Cash accounting is popular among the states because it makes it easier to show a positive balance.

Even so, there's no denying Wisconsin's financial picture has improved during the last year. Walker and the Republicans who run the state Capitol in Madison made a lot of difficult decisions — including their highly controversial move to strictly limit collective bargaining for most public employees. That helped save on labor costs while prompting massive protests at the Capitol in Madison.

Did Walker have to do that to fix the state's chronic budget mess? Maybe not. Yet it certainly made it easier for him to improve the state's bottom line. It also helped local public schools absorb a huge cut in state aid while minimizing teacher layoffs and harm to student instruction.

Walker and Co. continue to face some of the same financial challenges as Illinois, including a rapid increase in Medicaid costs. Walker's budget increased spending on this health care program for the poor and disabled by more than $1 billion. By comparison, the budget's tax breaks and fee cuts were small.

Walker has made his share of mistakes. Yet even Walker's Democratic opponent for governor in 2010 — Milwaukee Mayor Tom Barrett — promised not to raise taxes to fix last year's deficit.

Illinois went one direction last year in search of a budget solution. Wisconsin took a different path — with better financial results.

..Copyright 2012 madison.com. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

skip to main |

skip to sidebar

And tell your friends too!!!

Obama was an Alinsky trainer at ACORN

WRD began in January 2010 at the height of the Obamacare debacle. Since then, WRD banded with a group of like-minded individuals to form the Gadsden Group, influencing thought by challenging bias at the Milwaukee Journal Sentinel, volunteering for Republican candidates, participating in numerous campaign events, networking with other groups of concerned citizens, and gaining a foothold in social media on Twitter. Our "Letter to to the Left" after Governor Walker's convincing win in the June 2012 recall election went viral, and we decided to officially expand this site to include the Gadsden Group name.

We hope this site will be a one-stop shop for great websites, articles, polls, conservative commentary, and more. 2010 was the year of the Republican comeback, and 2012 was off to a great start with the convincing win of Scott Walker, but we have much work to do after the Romney and Thompson defeats, and it's up to all of us to make it happen. Share with friends, convince your kids, do your part to get our great country back! Thanks for visiting our site! Wisconsin Republican Dad and everyone in the Gadsden Group

"I also am a total loser"

3 victories in 4 year, this is uncharted water. Take that you lefties!!!!

wish I had thought of this one!

Send your donation to the Trotsky/Alinsky Center for the Insane

Thanks NSA!

Yuck!

One of the worst things I've ever seen on social media, and that's saying something. Disgusting.

What's the penalty for treason again?

"I go skeetshooting all the time" LOL

Benghazi-Gate is the end of O's political career whether he wins re-election or not. Let's make it not.

"Thanks for ruining our 20th anniversary meanie!"

Dear Leader violates the Flag Code. He should be arrested for putting his image on the flag while being a sitting POTUS. People have died for our Flag. These $35 flags from obama.com are a National disgrace.

Try putting this one on your Dane County SUV!!!

Those guys are working overtime over there

What kind of a vile, despicable person drives this car? (A Hyundai in Detroit as well)

This Massachusetts billboard gets it right!

Thank you Clint Eastwood for the Empty Chair!!! Great stuff!

The day the people were forced to take back their country

Romney for 8, Ryan for 8, Walker for 8, Rubio for 8. Then we die old & happy.

The Wisconsin Boys welcome the next POTUS to WI, the state that saved a country!

What could possibly get between you and your doctor?

Your kids all thank you!

The 1770's flag has made a huge comeback, and for good reason...

"he even writes lefty"

Another great campaign slogan: "Transparency!"

Those marketing folks are working overtime over there...

Please stay in the right lane...

Don't let the Takers defeat the Makers: Defeat Obummer in 2012

I'm kinda diggin' the new slogan: transparency finally?

The Democracy will ceast to exist when you take away from those who are willing to work and give to those who would not.

--Thomas Jefferson

"available at fine clothiers and wherever English is Spoken"

"Republicans believe every day is the 4th of July, Democrats believe every day is April 15th."

Close your eyes...breathe deeply...imagine...

"Thomas, I really think we ought to include this???"

"or what lefties refer to as, those pesky little first 10 amendments that prevent us from stomping on the great unwashed"

Ronaldus Magnus, on a billboard in the Twin Cities

Media Trackers

MacIver Institute

Wisconsin Republican Dad's favorite links

- Breitbart

- American Thinker

- Americans For Prosperity

- Bernie Goldberg

- Bill O'Reilly

- Citizens for Responsible Government

- Dick Morris

- Drudge Report

- Fox News

- Freedom Works

- Grandsons of Liberty (WI)

- Heritage Foundation

- Hot Air

- Learn the Truth About Obama's Past

- Mark Belling

- Mark Levin

- Michelle Malkin

- Milwaukee Journal Sentinel

- National Review

- Paul Ryan

- Politico

- Real Clear Politics

- Red State

- Right Wisconsin

- Ron Johnson

- Scott Walker

- The Daily Caller

- Track liberal bias at the New York Times

- USA Today

- Vicki McKenna

- WISN Common Sense Central

- Where the lefties hang out

- Young America's Foundation

Follow us on Twitter @Gadsden_Group

And tell your friends too!!!

If you understand Alinsky, you understand Leftists

Obama was an Alinsky trainer at ACORN

Welcome to our blog!

WRD began in January 2010 at the height of the Obamacare debacle. Since then, WRD banded with a group of like-minded individuals to form the Gadsden Group, influencing thought by challenging bias at the Milwaukee Journal Sentinel, volunteering for Republican candidates, participating in numerous campaign events, networking with other groups of concerned citizens, and gaining a foothold in social media on Twitter. Our "Letter to to the Left" after Governor Walker's convincing win in the June 2012 recall election went viral, and we decided to officially expand this site to include the Gadsden Group name.

We hope this site will be a one-stop shop for great websites, articles, polls, conservative commentary, and more. 2010 was the year of the Republican comeback, and 2012 was off to a great start with the convincing win of Scott Walker, but we have much work to do after the Romney and Thompson defeats, and it's up to all of us to make it happen. Share with friends, convince your kids, do your part to get our great country back! Thanks for visiting our site! Wisconsin Republican Dad and everyone in the Gadsden Group

Total Pageviews

Blog Archive

About Us

- Wisconsin Republican Dad

- WRD: I'm just a dad and husband who's very worried about the direction this country is going, and decided it was time I got involved. I believe in fiscal restraint, personal responsibility, a much smaller goverment, fewer government programs, agencies, and entitlements, strong national defense, and justice for criminals. I want our borders strengthened, tort reform, a balanced budget, and deficit reduction. I believe in Constructionist judges, not liberals who legislate from the bench. I'm pro gun, I'm for expanding nuclear power and offshore drilling. By default, that makes me a conservative Republican. The liberals are killing this country, and worse, they know it. Their desire to be liked, to be seen as champions of the poor, while they continue to grow the welfare state, bothers me greatly. Because arrogance is the worst of human traits, their condescension (that means you Russ Feingold) towards middle America makes me want to scream. So I am... Gadsden Group: We are a group of like-minded individuals based in Waukesha and Milwaukee counties (WI). We're sick of liberals running our state into the ground, so we decided to make a stand. So far, so good...

Very, very true...

Liberal tears....

"I also am a total loser"

We won! Again!!!

3 victories in 4 year, this is uncharted water. Take that you lefties!!!!

This says it all perfectly

wish I had thought of this one!

Leftists...

Differences

Please, can you help us find a cure?

Send your donation to the Trotsky/Alinsky Center for the Insane

The official definition of liberal

Obama's Desktop

Thanks NSA!

Sounds about right...

Sounds about Right

Please, no more desecration of the White House from these Hippies

Yuck!

Perhaps the best t-shirt evah!

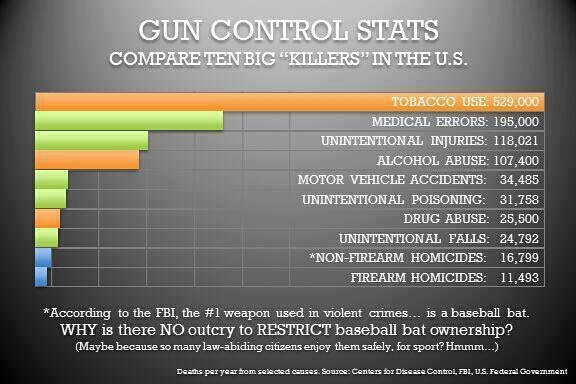

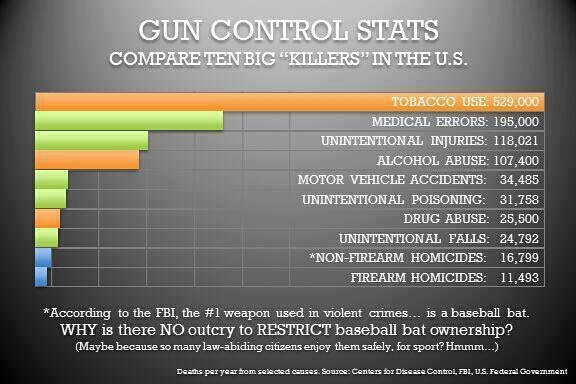

2A

Here's one man who can save our counrty

That liberal lion, John F. Kennedy

Welcome to Wisconsin

The sick freak polymath22 posted this fake image of murdered Martin Richard

One of the worst things I've ever seen on social media, and that's saying something. Disgusting.

TRAITORS! TREASON!!!

What's the penalty for treason again?

What we're up against, #5,678,890

Our Idiot in Chief using his Prompter

"I go skeetshooting all the time" LOL

"What Difference Does it Make?"

Ronald Reagan (deceased) summarizes the Newtown killings

"We must reject the idea that every time a law's broken, society is guilty rather than the lawbreaker." -

--Ronald Reagan

--Ronald Reagan

And it begins...God Help us

Watching Americans die in Benghazi, and not assisting, leads to:

What have we done...

Oct. 25th, 2012 cover, New York Post

Benghazi-Gate is the end of O's political career whether he wins re-election or not. Let's make it not.

Words spoken were never truer...and he said them!!!

If looks could kill...

"Thanks for ruining our 20th anniversary meanie!"

DEFICIT!

Obamanation

This flag desecrator must be stopped NOW!!!

Dear Leader violates the Flag Code. He should be arrested for putting his image on the flag while being a sitting POTUS. People have died for our Flag. These $35 flags from obama.com are a National disgrace.

Now that's funny!

Try putting this one on your Dane County SUV!!!

The New Obama Slogan

Those guys are working overtime over there

My buddy Al G. from near Detroit took this photo...

What kind of a vile, despicable person drives this car? (A Hyundai in Detroit as well)

Thank goodness we're all computer-savvy!

This Massachusetts billboard gets it right!

The best empty chair photo I've seen so far!

Thank you Clint Eastwood for the Empty Chair!!! Great stuff!

June 28, 2012

The day the people were forced to take back their country

I don't care who you are, that's funny!

The great Paul Ryan

Romney for 8, Ryan for 8, Walker for 8, Rubio for 8. Then we die old & happy.

This is perfect for Andrea Mitchell, since she already is a dog!

June 18, 2012

The Wisconsin Boys welcome the next POTUS to WI, the state that saved a country!

Obamacare

What could possibly get between you and your doctor?

Quote that pretty much says it all

"As an American, I am not so shocked that Obama was given the Nobel Peace Prize without any accomplishments to his name, but that America gave him the White House based on the same credentials." --Newt Gingrich

Congratulations to all the 54% ers!

Your kids all thank you!

Got it Leftists? Understand? I didn't think so...

The 1770's flag has made a huge comeback, and for good reason...

"Here's to hoping this isn't your kids' teacher"

Obama's New Bill of Rights

"he even writes lefty"

Obama Marketing team is hard at it!

Another great campaign slogan: "Transparency!"

New campaign slogan for the Obummer juggernaut

Those marketing folks are working overtime over there...

Let's drive a little more carefully this time, OK?

Please stay in the right lane...

Don't let the Takers defeat the Makers: Defeat Obummer in 2012

I'm kinda diggin' the new slogan: transparency finally?

Thomas Jefferson, not exactly a fan of the welfare (ie. liberal) state

The Democracy will ceast to exist when you take away from those who are willing to work and give to those who would not.

--Thomas Jefferson

Scott Walker's Phone # if needed

Governor Walker's office # is 608-266-1212. Please feel free to call him and thank him for everything he has done, if you have questions, anything at all. This is what transparency looks like!!!!

Dads Against Daughters Dating Democrats

"available at fine clothiers and wherever English is Spoken"

Ronald Reagan

"Republicans believe every day is the 4th of July, Democrats believe every day is April 15th."

www.thoseshirts.com

Close your eyes...breathe deeply...imagine...

A clause that didn't make the final draft

"Thomas, I really think we ought to include this???"

The Bill of Rights

"or what lefties refer to as, those pesky little first 10 amendments that prevent us from stomping on the great unwashed"

I wonder what he's thinking now???

Ronaldus Magnus, on a billboard in the Twin Cities