And they have the Bears and Cubs too. Talk about a mysery index, OMG. Can you say unions/pensions/unfunded liabilites/retired public secotr employees lounging in Florida? What do they expect with Leftists owning the dump? I wonder if IL can get turned around eventually--that is one blue state...

--WRD

Property tax bills anger Cook County homeowners

CHICAGO (CBS) — It's sticker shock in the mail. Tax bills went out to Cook County homeowners this week and the big jump in the amount due to many homeowners has some wondering if they can keep their house.

CBS 2′s Dana Kozlov takes a look at how the dramatic jump in property tax bills is affecting people and what you can do about it.

According to the Cook County Clerk's office, tax rates are up for schools, park districts, municipalities and other government bodies. Some of those tax levies have made double-digit increases in tax rates.

The property tax reality was setting in with Markham homeowner Patricia Taylor on Wednesday.

Asked if she can keep her house after receiving an $8,100 property tax bill, Taylor said, "I don't know right now. It's bad right now, it's really bad."

That's because her property tax bill for her three bedroom, one bathroom house shot up from $6,400 last year to $8,100 this year — a whopping 27 percent jump.

Taylor took time on her day off to head to the Cook County Assessor's office to see if anything could be done for herself and her mother.

"What do they expect? I don't live in Beverly Hills, I stay in Markham and this is ridiculous," Taylor said.

Kelley Quinn, spokeswoman for Cook County Assessor Joseph Berrios, said the office has had thousands of taxpayers like Taylor walk through their halls this week, wondering what was going on with their bills.

Countywide, property tax bills will jump an average of almost 2.7 percent, according to Quinn.

"What we're seeing are a lot of anxious people," Quinn said. "But what we're also seeing is once they leave here, they're satisfied and many of them are happy because they are seeing a tax bill that does go down a bit."

Quinn said many of the people voicing complaints about their tax bills are senior citizens who didn't apply for their senior exemption, which they must do every year, because of a new law.

Those seniors can still get their exemption with help from the county.

But everyone else? They could be out of luck, because taxing districts — from schools to parks — needed the extra revenue and the taxpayers were forced to foot the bill.

"So your local tax rates are going up, even though your assessments are going down, which results ultimately in a tax bill that could be a little bit higher," Quinn said.

People who believe their tax bills are incorrectly assessed can appeal through the Cook County Board of Review, but dates for that are very specific and depend on your township.

You can check the Board of Review website or give the office a call at (312) 603-7550 if you have questions.

..

skip to main |

skip to sidebar

And tell your friends too!!!

Obama was an Alinsky trainer at ACORN

WRD began in January 2010 at the height of the Obamacare debacle. Since then, WRD banded with a group of like-minded individuals to form the Gadsden Group, influencing thought by challenging bias at the Milwaukee Journal Sentinel, volunteering for Republican candidates, participating in numerous campaign events, networking with other groups of concerned citizens, and gaining a foothold in social media on Twitter. Our "Letter to to the Left" after Governor Walker's convincing win in the June 2012 recall election went viral, and we decided to officially expand this site to include the Gadsden Group name.

We hope this site will be a one-stop shop for great websites, articles, polls, conservative commentary, and more. 2010 was the year of the Republican comeback, and 2012 was off to a great start with the convincing win of Scott Walker, but we have much work to do after the Romney and Thompson defeats, and it's up to all of us to make it happen. Share with friends, convince your kids, do your part to get our great country back! Thanks for visiting our site! Wisconsin Republican Dad and everyone in the Gadsden Group

"I also am a total loser"

3 victories in 4 year, this is uncharted water. Take that you lefties!!!!

wish I had thought of this one!

Send your donation to the Trotsky/Alinsky Center for the Insane

Thanks NSA!

Yuck!

One of the worst things I've ever seen on social media, and that's saying something. Disgusting.

What's the penalty for treason again?

"I go skeetshooting all the time" LOL

Benghazi-Gate is the end of O's political career whether he wins re-election or not. Let's make it not.

"Thanks for ruining our 20th anniversary meanie!"

Dear Leader violates the Flag Code. He should be arrested for putting his image on the flag while being a sitting POTUS. People have died for our Flag. These $35 flags from obama.com are a National disgrace.

Try putting this one on your Dane County SUV!!!

Those guys are working overtime over there

What kind of a vile, despicable person drives this car? (A Hyundai in Detroit as well)

This Massachusetts billboard gets it right!

Thank you Clint Eastwood for the Empty Chair!!! Great stuff!

The day the people were forced to take back their country

Romney for 8, Ryan for 8, Walker for 8, Rubio for 8. Then we die old & happy.

The Wisconsin Boys welcome the next POTUS to WI, the state that saved a country!

What could possibly get between you and your doctor?

Your kids all thank you!

The 1770's flag has made a huge comeback, and for good reason...

"he even writes lefty"

Another great campaign slogan: "Transparency!"

Those marketing folks are working overtime over there...

Please stay in the right lane...

Don't let the Takers defeat the Makers: Defeat Obummer in 2012

I'm kinda diggin' the new slogan: transparency finally?

The Democracy will ceast to exist when you take away from those who are willing to work and give to those who would not.

--Thomas Jefferson

"available at fine clothiers and wherever English is Spoken"

"Republicans believe every day is the 4th of July, Democrats believe every day is April 15th."

Close your eyes...breathe deeply...imagine...

"Thomas, I really think we ought to include this???"

"or what lefties refer to as, those pesky little first 10 amendments that prevent us from stomping on the great unwashed"

Ronaldus Magnus, on a billboard in the Twin Cities

Media Trackers

MacIver Institute

Wisconsin Republican Dad's favorite links

- Breitbart

- American Thinker

- Americans For Prosperity

- Bernie Goldberg

- Bill O'Reilly

- Citizens for Responsible Government

- Dick Morris

- Drudge Report

- Fox News

- Freedom Works

- Grandsons of Liberty (WI)

- Heritage Foundation

- Hot Air

- Learn the Truth About Obama's Past

- Mark Belling

- Mark Levin

- Michelle Malkin

- Milwaukee Journal Sentinel

- National Review

- Paul Ryan

- Politico

- Real Clear Politics

- Red State

- Right Wisconsin

- Ron Johnson

- Scott Walker

- The Daily Caller

- Track liberal bias at the New York Times

- USA Today

- Vicki McKenna

- WISN Common Sense Central

- Where the lefties hang out

- Young America's Foundation

Follow us on Twitter @Gadsden_Group

And tell your friends too!!!

If you understand Alinsky, you understand Leftists

Obama was an Alinsky trainer at ACORN

Welcome to our blog!

WRD began in January 2010 at the height of the Obamacare debacle. Since then, WRD banded with a group of like-minded individuals to form the Gadsden Group, influencing thought by challenging bias at the Milwaukee Journal Sentinel, volunteering for Republican candidates, participating in numerous campaign events, networking with other groups of concerned citizens, and gaining a foothold in social media on Twitter. Our "Letter to to the Left" after Governor Walker's convincing win in the June 2012 recall election went viral, and we decided to officially expand this site to include the Gadsden Group name.

We hope this site will be a one-stop shop for great websites, articles, polls, conservative commentary, and more. 2010 was the year of the Republican comeback, and 2012 was off to a great start with the convincing win of Scott Walker, but we have much work to do after the Romney and Thompson defeats, and it's up to all of us to make it happen. Share with friends, convince your kids, do your part to get our great country back! Thanks for visiting our site! Wisconsin Republican Dad and everyone in the Gadsden Group

Total Pageviews

Blog Archive

About Us

- Wisconsin Republican Dad

- WRD: I'm just a dad and husband who's very worried about the direction this country is going, and decided it was time I got involved. I believe in fiscal restraint, personal responsibility, a much smaller goverment, fewer government programs, agencies, and entitlements, strong national defense, and justice for criminals. I want our borders strengthened, tort reform, a balanced budget, and deficit reduction. I believe in Constructionist judges, not liberals who legislate from the bench. I'm pro gun, I'm for expanding nuclear power and offshore drilling. By default, that makes me a conservative Republican. The liberals are killing this country, and worse, they know it. Their desire to be liked, to be seen as champions of the poor, while they continue to grow the welfare state, bothers me greatly. Because arrogance is the worst of human traits, their condescension (that means you Russ Feingold) towards middle America makes me want to scream. So I am... Gadsden Group: We are a group of like-minded individuals based in Waukesha and Milwaukee counties (WI). We're sick of liberals running our state into the ground, so we decided to make a stand. So far, so good...

Very, very true...

Liberal tears....

"I also am a total loser"

We won! Again!!!

3 victories in 4 year, this is uncharted water. Take that you lefties!!!!

This says it all perfectly

wish I had thought of this one!

Leftists...

Differences

Please, can you help us find a cure?

Send your donation to the Trotsky/Alinsky Center for the Insane

The official definition of liberal

Obama's Desktop

Thanks NSA!

Sounds about right...

Sounds about Right

Please, no more desecration of the White House from these Hippies

Yuck!

Perhaps the best t-shirt evah!

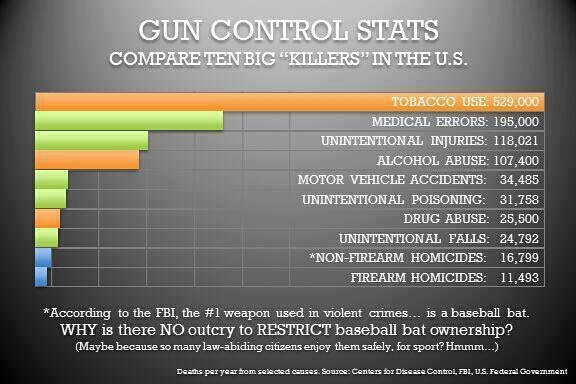

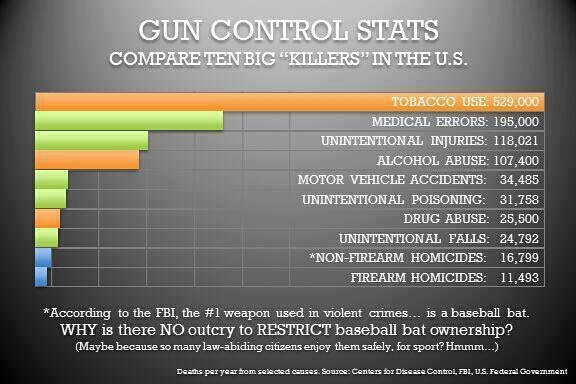

2A

Here's one man who can save our counrty

That liberal lion, John F. Kennedy

Welcome to Wisconsin

The sick freak polymath22 posted this fake image of murdered Martin Richard

One of the worst things I've ever seen on social media, and that's saying something. Disgusting.

TRAITORS! TREASON!!!

What's the penalty for treason again?

What we're up against, #5,678,890

Our Idiot in Chief using his Prompter

"I go skeetshooting all the time" LOL

"What Difference Does it Make?"

Ronald Reagan (deceased) summarizes the Newtown killings

"We must reject the idea that every time a law's broken, society is guilty rather than the lawbreaker." -

--Ronald Reagan

--Ronald Reagan

And it begins...God Help us

Watching Americans die in Benghazi, and not assisting, leads to:

What have we done...

Oct. 25th, 2012 cover, New York Post

Benghazi-Gate is the end of O's political career whether he wins re-election or not. Let's make it not.

Words spoken were never truer...and he said them!!!

If looks could kill...

"Thanks for ruining our 20th anniversary meanie!"

DEFICIT!

Obamanation

This flag desecrator must be stopped NOW!!!

Dear Leader violates the Flag Code. He should be arrested for putting his image on the flag while being a sitting POTUS. People have died for our Flag. These $35 flags from obama.com are a National disgrace.

Now that's funny!

Try putting this one on your Dane County SUV!!!

The New Obama Slogan

Those guys are working overtime over there

My buddy Al G. from near Detroit took this photo...

What kind of a vile, despicable person drives this car? (A Hyundai in Detroit as well)

Thank goodness we're all computer-savvy!

This Massachusetts billboard gets it right!

The best empty chair photo I've seen so far!

Thank you Clint Eastwood for the Empty Chair!!! Great stuff!

June 28, 2012

The day the people were forced to take back their country

I don't care who you are, that's funny!

The great Paul Ryan

Romney for 8, Ryan for 8, Walker for 8, Rubio for 8. Then we die old & happy.

This is perfect for Andrea Mitchell, since she already is a dog!

June 18, 2012

The Wisconsin Boys welcome the next POTUS to WI, the state that saved a country!

Obamacare

What could possibly get between you and your doctor?

Quote that pretty much says it all

"As an American, I am not so shocked that Obama was given the Nobel Peace Prize without any accomplishments to his name, but that America gave him the White House based on the same credentials." --Newt Gingrich

Congratulations to all the 54% ers!

Your kids all thank you!

Got it Leftists? Understand? I didn't think so...

The 1770's flag has made a huge comeback, and for good reason...

"Here's to hoping this isn't your kids' teacher"

Obama's New Bill of Rights

"he even writes lefty"

Obama Marketing team is hard at it!

Another great campaign slogan: "Transparency!"

New campaign slogan for the Obummer juggernaut

Those marketing folks are working overtime over there...

Let's drive a little more carefully this time, OK?

Please stay in the right lane...

Don't let the Takers defeat the Makers: Defeat Obummer in 2012

I'm kinda diggin' the new slogan: transparency finally?

Thomas Jefferson, not exactly a fan of the welfare (ie. liberal) state

The Democracy will ceast to exist when you take away from those who are willing to work and give to those who would not.

--Thomas Jefferson

Scott Walker's Phone # if needed

Governor Walker's office # is 608-266-1212. Please feel free to call him and thank him for everything he has done, if you have questions, anything at all. This is what transparency looks like!!!!

Dads Against Daughters Dating Democrats

"available at fine clothiers and wherever English is Spoken"

Ronald Reagan

"Republicans believe every day is the 4th of July, Democrats believe every day is April 15th."

www.thoseshirts.com

Close your eyes...breathe deeply...imagine...

A clause that didn't make the final draft

"Thomas, I really think we ought to include this???"

The Bill of Rights

"or what lefties refer to as, those pesky little first 10 amendments that prevent us from stomping on the great unwashed"

I wonder what he's thinking now???

Ronaldus Magnus, on a billboard in the Twin Cities